You have the idea, the drive, and hopefully the funding, but as a small business owner, you’ll be faced with a plethora of decisions from conception to day-one operations. Choosing the right financial institution is not the least of them.

Careful consideration needs to be taken when banking on your financial services provider.

Small businesses account for 99.9 percent of businesses in the United States, the Small Business Administration reports, so it’s no surprise that most financial institutions are vying for your business.

Unsurprisingly, more than two-thirds (79 percent) of respondents in a survey of 600 small business owners (with an annual revenue of up to $20 million) use the same financial organization for both their personal and business financial needs, according to the Banking Administration Institute, a Chicago-based nonprofit financial services research firm.

Yet another survey by PwC, of 570 small and medium-sized businesses taken during the COVID-19 pandemic shows that slightly more than one-fifth (22 percent) are considering switching financial institutions in the next 12 months.

Exercising your due diligence begins by educating yourself on what you can and should expect from your financial institution.

What Your Financial Institution Can Do for You

Rather than provide you with a humdrum list, we interviewed small business owners to ask them for some tips about what helped their bottom lines and what features they look for in a bank.

1. Understands My Business Needs

The most essential banking tip is that you need to remember that you are the customer. Your banking needs come first. That’s what Rachel Worley, architect and founder of Three Dot Design realized when she started her business while raising her children.

Worley initially stuck with her local bank to open her business account, but the branch was not a good fit for a client with children in tow.

Worley’s business account setup took nearly two hours while a new employee learned on the job. Watching her preschool-age children while waiting, she recalls “I tried the free mints, the free pens, asking how much longer, anything!”

After her experience, Worley searched for a new bank, and chose three to sample nearby. Worley knew she needed a child-friendly branch, so she looked at the busyness of the branch, how staffers treated customers, and how she was treated as a client with a child.

“There was a clear winner when the bank manager gave me her personal cell phone, and said I could call or email her about anything — she has lived up to her word. They also rocked the Paycheck Protection Program (PPP) process.”

2. Builds a Relationship of Trust

“Transparency for both me and the bank is a big deal for me,” says Matthew Paxton, founder of Hypernia, a review site for gaming equipment. “I need to know all the details, like any hidden fees.”

He adds that “open communication is paramount when you’re building trust with your business partners. I want to know that I can contact you anytime I need information about our financial situation.”

3. Values Being More Than a Lender

Look for an institution that understands what you’re facing. Community banks may be a smart bet. “Many banks are small businesses too,” notes Bill Kroll, former executive vice president of the American Bankers Association.

“Let your community bank be a trusted advisor to help you through this time (COVID-19). The hallmark of community banking is you’re not calling an 800 number based out of Tucson — your bank knows its community, from if it snowed heavily last night to how difficult times are.”

4. Offers Technology and Convenience

Online banking is a necessity in today’s financial world. More than a quarter (27 percent) of small business owners have shifted to online banking since the start of the pandemic, PwC’s survey shows. It’s notable that 6 percent changed to branch banking in this time, as well.

An institution that provides easy access not only to your financials, but to other features such as online check deposits and money transfers from the comfort of your home online is essential.

Consider if the institution offers services like digital account opening, mobile banking, peer-to-peer payments such as those offered by Venmo and Zelle, or perhaps artificial intelligence to promote a smoother banking experience and cut wait times — if, of course, you will actually use it and benefit from it in your day-to-day.

5. Has a Clear Fee Structure

You shouldn’t have to dig deep to find out what fees you will be paying for each service. Do your research beforehand to help avoid any surprises down the line.

Some banking language may not be clear, so always be ready to ask questions and seek out helpful tips.

Banks often limit the number of transactions that can be made in a month and may charge a fee if you exceed that limit. Financial institutions may also charge a fee for issuing multiple cards to an account, so if you plan on giving employees cards to make business purchases, look into this beforehand so you are aware of the cost.

“Look past the marketing and focus on the small print,” says John Bedford, founder of cooking technology site Viva Flavor. “When I researched banks for my new business in 2019, I found the devil was always in the details. Many offer a grace period for recurring monthly fees, but look carefully at the costs that kick in when the grace period expires.”

“A longer grace period may seem tempting when you launch, but it’s a false economy if it ends up costing you more. You should also have a clear understanding of how you’ll receive payments,” Bedford adds. “Study the fine print before committing.”

6. Provides Access to Senior Management

An essential banking tip that Kroll notes is that it’s vital for banks to give customers access to senior management. “Banks often ignore their best customers — they think a relationship manager is enough to service the client. But well-run banks take the time to know the needs of the people behind the small businesses.”

Kroll remembers a community bank in Maryland, whose chairperson would organize a golfing day and cookout for its commercial borrowers and the executive members of the bank. It generated goodwill among the small business owners, and gave them a chance to mingle. “That personal touch helps a great deal — in normal times of course,” Kroll adds.

Banks that value your relationship may be better equipped to provide necessary service to your business long term.

Bill Kroll lists his top considerations before settling down with a financial services provider.

- Access: The institution should have a website or portal that’s mobile or tablet accessible. “Community banks are struggling because it can be expensive for them to keep up,” Kroll says. “Technology has to be worth it for the bank and for the customers. I personally believe that ‘free’ is not what they’re looking for, rather value for money and access.”

- Dealing With Payments: More and more companies are conducting international transactions thanks to the internet — having a secure payment process is essential. “People sell stuff out of their house and send it all over the world. Ask yourself how is the financial institution securing that payment and expediting it for the customer?”

- Speed of Payment: How long does the financial institution take to process incoming and outgoing payments?

- Big Bank or Community Bank: If your business has under $10 million in annual sales, a community bank should be well-equipped to handle your business. Anything above $10 million — or if you depend on international transactions — consider a larger financial institution. There are typically larger fees on international transactions with smaller community banks.

7. Has a Solid Operating History

If consistency and trust matter to you, understanding the credibility of your financial institution and the length of its operating history is paramount.

“I want to see enough experience in an institution’s work before I decide to trust it with my business,” says Nick Chernets, CEO of Data for SEO, a company that provides application programming interfaces for SEO-software companies. “Unfortunately, I’ve had bad experiences in the past which is why I am so cautious.”

“Several years ago, I decided to sign up for a credit program in a newly formed bank that seemed to be professional. It was a great low-interest credit program and focused on supporting small business owners, so my idea was to use the credit to scale up our work.”

“However, a few months after I signed up for the program, the bank changed leadership, and it was downhill from there,” Chernets adds.

“Suddenly, I couldn’t reach advisors easily. The bank introduced new conditions for all clients, and it felt like torture by the time I completed the program. To prevent a similar scenario, I always look for a financial institution’s work history.”

A good place to start in evaluating a financial institution is to see if they are insured by the Federal Deposit Insurance Corporation in the case of banks or by the National Credit Union Association for credit unions.

8. Accommodates Through Anything — Like a Pandemic

Another important banking tip is that, as COVID-19 shows, we can face financial challenges unexpectedly. The value of a financial service provider who is malleable and can be there for you through thick and thin cannot be understated.

The latest test for financial services was how quickly they could roll out PPP loans.

These loans were designed to help small business owners during the pandemic, but some customers felt frustrated by their experience.

The leading customer complaint was lack of transparency around the qualification criteria from the federal government, followed closely by frustration at the speed in which the loans were processed, according to the same PwC survey.

Almost a quarter of survey respondents wanted their bank to make the application process simpler, and hoped for clearer channels of communication for questions during the application process.

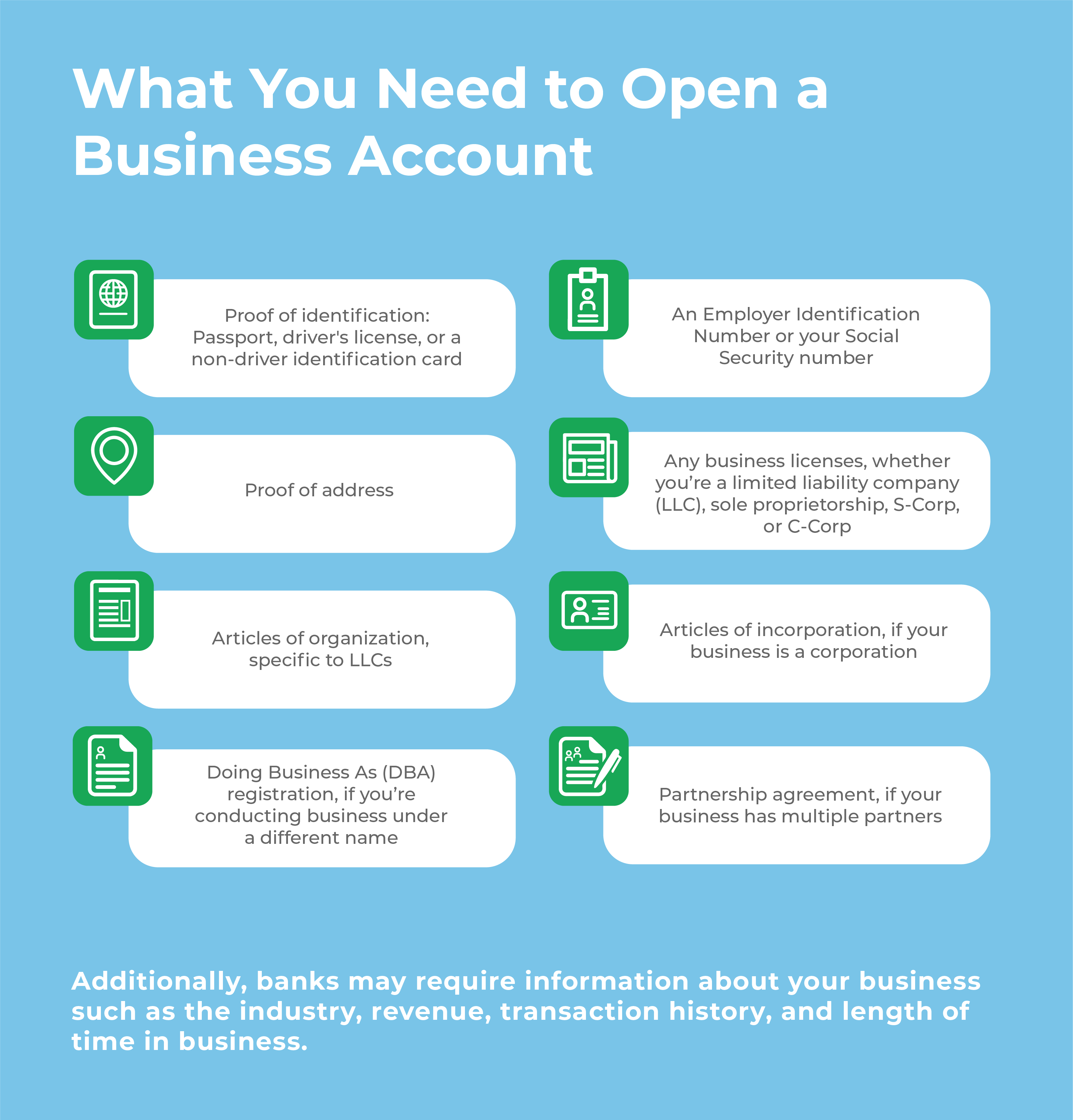

What You Need to Open a Business Account

Here’s the list of documents you may need to bring to open your account:

- Proof of identification: in the form of a passport, driver’s license, or a non-driver identification card

- An Employer Identification Number or your Social Security number

- Proof of address: both personal and business, if applicable

- Any business licenses, whether you’re a limited liability company (LLC), sole proprietorship, S-Corp, or C-Corp

- Articles of organization, specific to LLCs

- Articles of incorporation, if your business is a corporation

- Doing Business As registration, if you’re conducting business under a different name

- Partnership agreement, if your business has multiple partners

Additionally, banks may require information about your business such as the industry, revenue or transaction history, and length of time in business. It may be helpful to seek out others in your industry to ask them for tips about their necessary documents when banking.

The Bottom Line

There are a multitude of factors to consider when choosing a financial institution to support your burgeoning business.

Bigger institutions may have more technology, for example. “Online banking is much more convenient and less time-consuming,” says entrepreneur Kevin Mercier.

“Unfortunately, online banking services are more common in larger commercial banks,” Mercier adds. “Smaller community banks offer more competitive interest rates. If you want to choose a small community bank for your business, make sure it offers online banking services.”

Smaller banks, however, may make more advantageous risk decisions when things don’t all fit the mold. Where you should be has a lot to do with where you are and what you want; it is truly not a one-size fits all.

Only you know if it’s a good time to start a business. Whether you choose to go with a national, regional, local bank or credit union, make sure you map out your “must haves,” “nice to haves,” and products or services that don’t move the needle.